The price of Bitcoin, the pioneering cryptocurrency, has been the subject of intense scrutiny and speculation since its inception. Understanding the multitude of factors that influence the price of Bitcoin is essential for traders, investors, and enthusiasts seeking to comprehend the dynamics of this groundbreaking digital asset. In this blog post, we unravel the complex web of elements that determine the price of Bitcoin, shedding light on the diverse forces that shape its valuation in the global marketplace.

Supply and Demand Dynamics

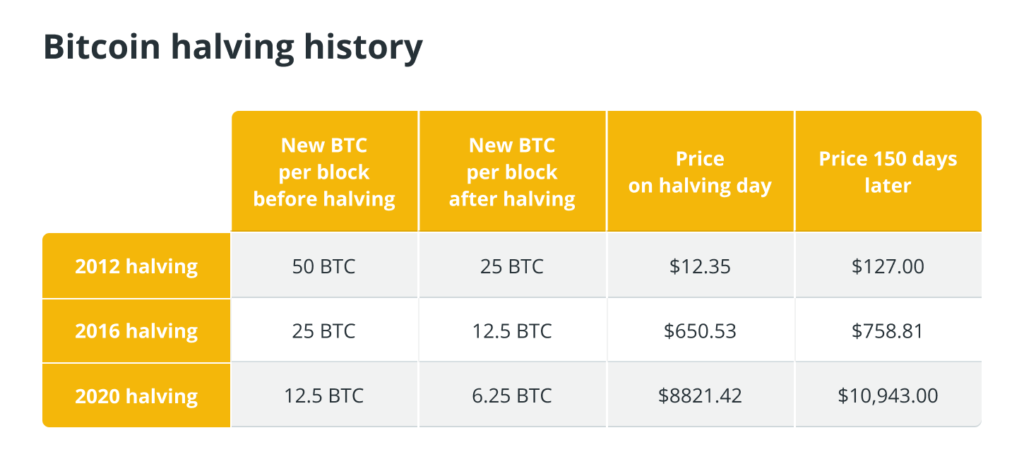

At the core of Bitcoin’s price determination lies the fundamental interplay between supply and demand. The fixed supply cap of 21 million coins, coupled with the protocol’s deflationary issuance schedule, establishes Bitcoin as a scarce digital asset. Fluctuations in demand, driven by factors such as macroeconomic conditions, institutional adoption, and retail interest, exert significant influence on the price of Bitcoin. As demand for Bitcoin surges, the limited supply can lead to upward pressure on its price, while waning demand may contribute to downward price movements.

Market Sentiment and Speculation

The sentiment of market participants, ranging from individual retail investors to institutional entities, plays a pivotal role in shaping the price of Bitcoin. Positive sentiment, driven by factors such as regulatory developments, technological advancements, and macroeconomic trends, can fuel heightened demand and price appreciation. Conversely, negative sentiment, stemming from regulatory uncertainty or market volatility, may contribute to sell-offs and downward price pressure. Speculative activity, driven by the anticipation of future price movements, also influences short-term price dynamics in the Bitcoin market.

Technological and Developmental Progress

The evolution of Bitcoin’s underlying technology and its developmental ecosystem can impact its price trajectory. Upgrades to the Bitcoin protocol, advancements in scalability and privacy solutions, and improvements in user experience can enhance the utility and desirability of Bitcoin, potentially leading to increased demand and positive price movements. Moreover, developments in the broader blockchain and cryptocurrency space, such as interoperability solutions and decentralized finance (DeFi) applications, can contribute to the overall market sentiment and influence Bitcoin’s price dynamics.

Macroeconomic and Geopolitical Factors

External macroeconomic and geopolitical developments wield substantial influence over the price of Bitcoin. Economic instability, currency devaluation, and inflationary pressures can drive heightened interest in Bitcoin as a potential hedge against traditional financial risks. Geopolitical events, regulatory actions, and monetary policy decisions by central banks can also impact market sentiment and influence the demand for Bitcoin as a store of value or alternative investment asset.

Adoption and Integration

The integration of Bitcoin into traditional financial systems, as well as its adoption within institutional and corporate frameworks, can have a profound impact on its price. Institutional investment, the launch of Bitcoin-related financial products such as futures contracts and exchange-traded funds (ETFs), and corporate treasury allocations to Bitcoin can contribute to increased demand and positive price movements. Additionally, the expansion of Bitcoin’s utility through merchant adoption and payment solutions can influence its long-term price dynamics.

Conclusion: Navigating the Complexities of Bitcoin Price Determinants

In conclusion, the price of Bitcoin is influenced by a multifaceted interplay of supply and demand dynamics, market sentiment, technological advancements, macroeconomic conditions, and the evolving landscape of adoption and integration. By comprehensively understanding the diverse factors that determine Bitcoin’s price, market participants can gain valuable insights into the cryptocurrency’s valuation and position themselves to navigate the complexities of the Bitcoin market with greater insight and informed decision-making.