In the dynamic and ever-evolving landscape of cryptocurrency markets, the concepts of inflows and outflows play a pivotal role in shaping market sentiments and influencing price movements. The movement of digital assets into and out of cryptocurrency exchanges carries significant implications for traders, investors, and the broader market ecosystem. In this blog post, we delve into the intricacies of inflows and outflows in crypto exchanges, shedding light on their impact and implications within the cryptocurrency market.

Deciphering Inflows and Outflows

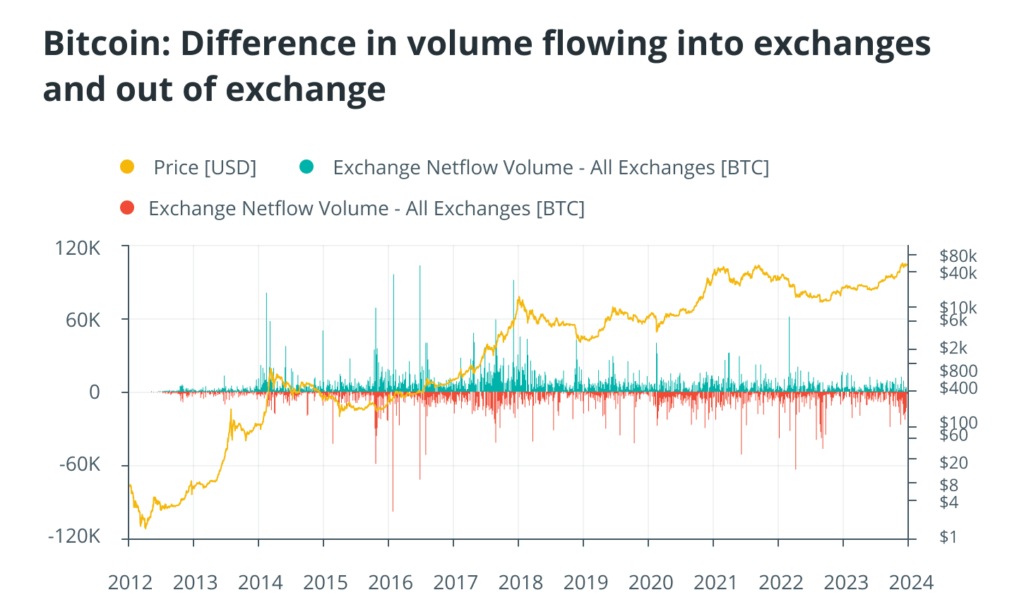

In the realm of cryptocurrency exchanges, inflows and outflows refer to the movement of digital assets, such as Bitcoin, Ethereum, and various altcoins, into and out of exchange platforms. Inflows entail the transfer of assets into exchanges, potentially signaling increased selling or liquidity provision, while outflows denote the movement of assets out of exchanges, often indicative of decreased selling pressure or the accumulation of assets by traders and investors.

Market Sentiment and Trading Activity

The analysis of inflows and outflows offers valuable insights into market sentiment and trading activity within the cryptocurrency space. Large inflows of digital assets into exchanges may signify an uptick in selling pressure, as traders and investors position themselves to execute sell orders or capitalize on short-term trading opportunities. Conversely, substantial outflows from exchanges may signal decreased selling activity, potentially indicating a shift towards long-term holding strategies or the transfer of assets to secure off-exchange storage solutions.

Impact on Price Dynamics

The patterns of inflows and outflows can exert notable influence on the price dynamics of digital assets. Heightened inflows into exchanges, particularly during periods of market volatility, may contribute to increased sell-side pressure, potentially exerting downward pressure on prices as sellers seek to liquidate their holdings. Conversely, sustained outflows from exchanges may reduce the available supply of assets on trading platforms, potentially contributing to upward price movements as demand outstrips the available supply.

Liquidity and Exchange Dynamics

Inflows and outflows also play a critical role in shaping the liquidity profile and exchange dynamics within the cryptocurrency market. Large inflows of assets into exchanges can bolster liquidity, providing traders with increased opportunities to execute buy and sell orders. Conversely, significant outflows may lead to reduced liquidity on exchanges, potentially affecting price slippage and the efficiency of order execution for market participants.

Investor Behavior and Long-Term Accumulation

The analysis of inflows and outflows offers valuable insights into investor behavior and long-term accumulation trends. Sustained outflows from exchanges may indicate a growing propensity for investors to accumulate and hold assets off-exchange, reflecting a broader shift towards long-term investment strategies and the desire to secure assets in self-custody wallets or alternative storage solutions.

Conclusion: Interpreting Inflows and Outflows in Crypto Exchanges

In summary, the analysis of inflows and outflows in cryptocurrency exchanges is a critical component of market analysis, providing valuable insights into trading activity, market sentiment, and the dynamics of supply and demand. By closely monitoring the movement of digital assets into and out of exchanges, traders and investors can gain a deeper understanding of market dynamics and position themselves to navigate the complexities of the cryptocurrency market with greater insight and informed decision-making.

1 Comment

Porro eligendi corrupti numquam consectetur id autem quasi. qui voluptatibus molestiae. et eveniet doloremque inventore ducimus incidunt. Non consectetur cupiditate quibusdam Animi vitae culpa eveniet officia eius repellat. Fugit voluptates nobis ea aperiam. Molestiae velit veniam ex fuga fugiat vero. Voluptas minima ut.